Category: Some Coaching Programs at DDBIS

Monthly training schedule in DDBIS:ja]Monthly training schedule in DDBIS

TRAINING COURSE ABOUT ANALYZISING AND DESIGNING TABLES DESCRIPTION OF WORK

LEARNING COURSES FOR LABOR MANAGEMENT FOR SMALL AND MEDIUM ENTERPRISES.

TRAINING COURSE ABOUT ADVANCED PROFIT ANALYSIS REPORTING

TRAINING COURSE FOR BUILDING AN EFFECTIVE LABOR COST & BONUS SYSTEM FOR ENTERPRISES

Program Objectives

Help businesses understand how to build salary scale – bonus in the right position – capacity – efficiency of workers and towards ensuring internal and market justice in pay, thereby ensuring the ability to attract, retain and motivate employees, while helping to manage the business better, bringing high efficiency for businesses.

Course Content

- Overall income system

- Overview of the steps of the wage system

- The overall model of wage system

- Sort job title system

- Score method for evaluation factors

- Job analysis of positions / positions

- Create job value spreadsheet for all positions / titles of the business

- Fine-tune the point system, linked to the Salary Survey panel

- Method of adjusting salary for each individual after the new salary system is completed.

Share how the salary system is applied when there are cases:

- Salary adjustment due to temporary duties

- Salary adjustment due to structural change

- Salary adjustment when capacity changes

- Salary adjustment when the position changes

- Adjusting salary when macroeconomic factors impact on business

……………………………………………………………………………………………………………………………………………………………………………..

Information of Course Instructor

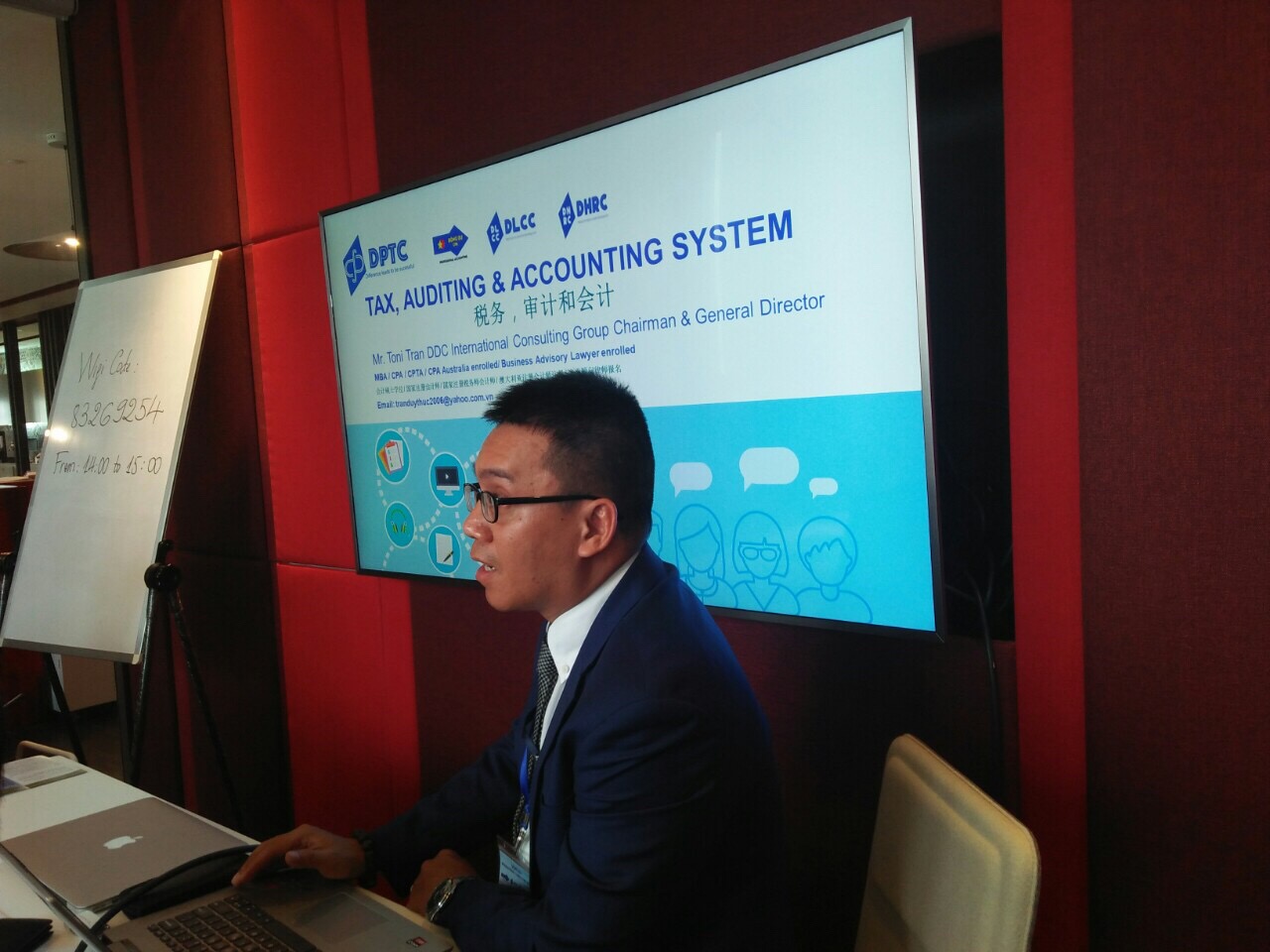

- Toni Tran (Mr)

- CEO SCS (Vietnam) Co., Ltd, Branch office 2004 – 2006.

- CFO Sagawa Express Vietnam Co., Ltd 2006 – 2008.

- CEO of Dong Du International Consulting Group 2008 – present.

- Lecturer at Hoa Sen University. Vietnam.

- Lecturer in Accounting University of Ho Chi Minh City, Vietnam.

- Lecturer at Ton Duc Thang University, Vietnam.

- Senior Consultant Association for SME Promotion of the Government of Japan 2008 (SMRJ)

- Member of the Association of Certified Public Accountants, VACPA.

- Member of the Association of Certified Public Accountants Vietnam, VAA.

- Member of Vietnam Tax Consultancy Association, VTA.

Courses and seminars already worked

- Teaching International Accounting Classes for Foreign and Vietnamese Students, Hoa Sen University, 2011.

- Teaching accounting classes for foreign and Vietnamese students, Hoa Sen University, 2010.

- Auditing class for foreign and Vietnamese students, Hoa Sen University, 2012.

- Teaching cost management accounting for foreign and Vietnamese students, Hoa Sen University, 2012.

- Accounting Workshop and Enterprise, Binh Duong Business Association, 2011.

- Vietnam Investment Consultation Workshop with AGS group, 2013.

- Management Accounting and Business Administration, Prime Joint Venture, SCG Group, 2017.

- Seminar on transfer pricing and enterprise in conjunction with IBM Institute for DIC Tan Cang, Cai Mep, 2017.

- Seminar on tax risk management and corporate merger with IBM Institute for DIC Tan Cang, Cai Mep, 2017.

- Seminar value chain & business model for Swiss master students of UBIS, IBM Institution, HCMC, 2017.

- Seminar value chain & business model for SMEs, TUV, German education corporation, HCMC.

- Seminar financial risk management for Plant Protection Company HCMC, IBM Institution, HCMC, 2017.

Training Course Timing: 1 day

Location: DPTC can conduct training classes at the DPTC center or at your company according to customer requirements.

Contact at the training center Dong Du_ DPTC

- Ms Saphia Duong.

- Gmail: saphia.rd.japanvietnam@gmail.com

- Phone: 0968 992 072

![「DDC] Outsourcing Vietnamese Accounting Services・ Tax Consulting・ Legal Consulting For FDis・Setting up FDIs in Vietnam・ Auditing・ Human Resources・ Market/Goods Investigation](http://japanvietnam.com.vn/wp-content/uploads/2021/06/cropped-Capture1-1.jpg)